InstaFunds+ : Money Manager, Budgeting, Bill Calendar, Resources

InstaFunds+ offer unlimited accounts and transactions, a bill calendar, and resources that will help you in making financial decisions.

InstaFunds helps you to become more financially organized and disciplined, while also increasing your financial literacy. Our goal is to not only be a simple money tracking app, but a budgeting tool, bill manager, and educational tool.

With our register/log in option, you can access your transactions from any iOS device with InstaFunds+.

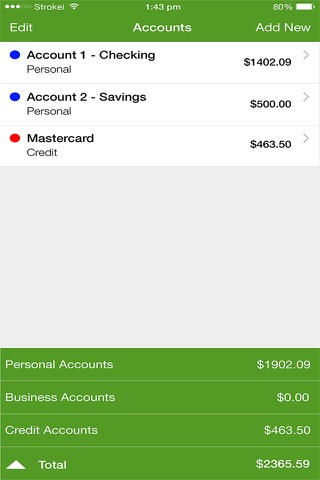

ACCOUNTS

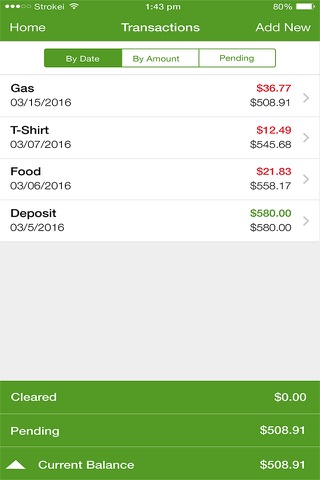

The app allows you to manually enter past, present, and even future transactions. Use InstaFunds as your personal finance manager. The ability to add future transactions also means you are able to budget by knowing how much you should have in your account at the end of a certain time period based on the current and predicted future transactions that will come from an account.

Use InstaFunds as your digital checkbook with the option of identifying what you purchased or used with each transaction (i.e. check, receipt, picture of the purchased item from the store) by taking a photo and attaching it to any transaction.

You can separate your accounts as personal, business, or checking. You can also identify the type of account by labeling each as checking, savings, CDs, or numerous other options.

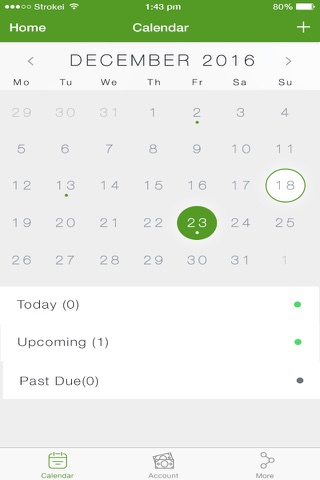

BILL CALENDAR

If you are a millennial, unbanked, underbanked, or have 4 different bank accounts, one thing that we all have in common is bills. Our bill calendar allows you to organize your bills and be sent reminders of when they are due. Our calendar monitors your bills by categorizing them as upcoming or past due.

Once you have paid a bill, simply mark the bill as paid and enter the confirmation number for your records.

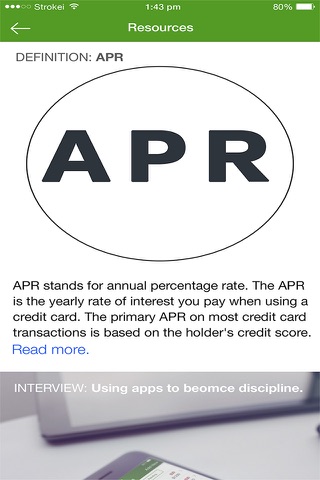

RESOURCES

Through InstaFunds, we will offer your numerous resources and opportunities to become more financially literate. Our resources include interviews, helpful articles, recommendations, and definitions and explanations about things you may see when trying to get a loan, credit card, or something similar. We want to make sure you are knowledgeable enough to make the right decision.

With a focus on the unbanked, underbanked, and under-resourced, we understand that many people are getting loans with extremely high interest rates, cashing their checks at the local store for a fee, and/or so deep in debt that they become hopeless. We use our resource section as a way of putting people on the right path to financial freedom.

OTHER FEATURES

- E-mail yourself personal transactions or export full accounts.

- Import data Now you have a record of your finances on your mobile device and on your computer.

- turn Reconcile on or off

- turn Security Code on or off. If your Security Code is on, you must enter a 4 digit code in order to access your accounts.

- Search feature to easily search through your transactions in all your accounts. Search by name, amount, or date.

- Order your transactions by Date, Clearance, or Amount

- Categorize your transactions. By visiting the Category page, you will be able to see the amount and percentage of money you have spent in each category. (You are free to add any category that is not already part of the app by default)

- Print off transactions. This includes printing off the picture that has been taken/assigned to each transaction.